rank real estate asset classes by risk

Within private equity real estate assets are typically grouped into four primary strategy categories based on investment strategy and perceived risk. The balance between the two is.

Asset Class Definition Types Of Asset Classes Franklin Templeton

Some examples of major asset classes include equities bonds money markets and real estate.

:max_bytes(150000):strip_icc()/AchieveOptimalAssetAllocation-01_2-8450dfb785a04b43b234ca4c050396db.png)

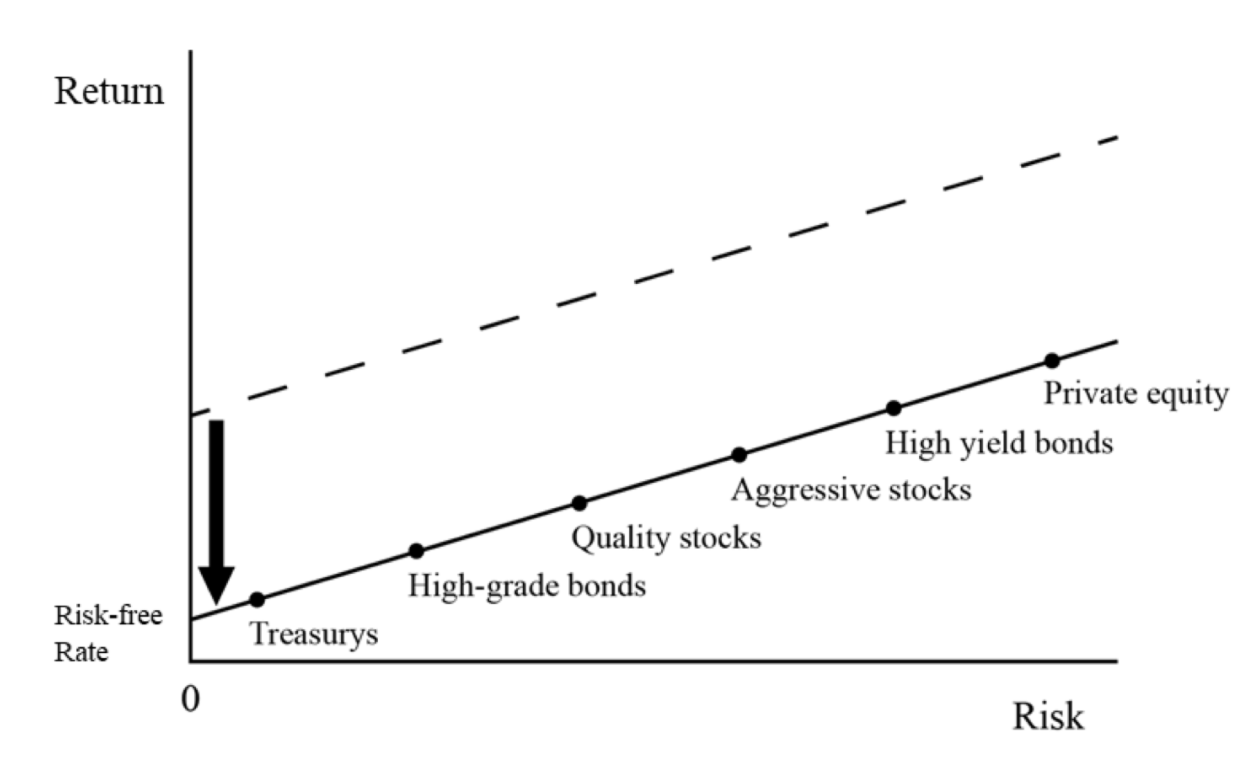

. High risk with high return to low risk with low return. Dear all Im having trouble to find arguments when ranking real estate asset classes in terms of risk. Real estate has the highest risk and the highest potential return.

One example would be Real Estate. Residential office indu s trial retail and hospitalityWithin each asset class properties will be. Asset class is a group of assets with similar characteristics particularly in terms of risk return liquidity and regulations.

Each of these plays a unique role in your portfolio providing. One way that real estate investors have tried to evaluate risk of 1 The Everything Everywhere Model is made commercially available through Northfield Information Services Inc. As an asset class real estate investments.

Equities stocks and fixed income bonds are traditional asset class. Asset Class Sector - Global Real Estate Primary Index SP Developed Property TR Index Broad Based Index SP Global REIT TR USD Net Assets 16654 Million Inception Date 10012007. Im mainly looking at.

For investors to take on higher risks they would need to be adequately compensated for the additional risks that they bear. 4 Private real estate. Ideally it contains an appropriate blend of investments from various asset classes such as stocks bonds and gold.

-Multifamily -Retail -Office -Student living -Light. However workforce multifamily has historically. The familiar term for equities.

In commercial real estate this gets defined as Class A. Vanguard Real Estate II Index 1205 American Tower Corp 940 Crown Castle International Corp 588 Prologis Inc 556 Equinix Inc 490. From asset class to asset risk is substituted into the portfolio by reducing exposures to fixed-income risk and public-equity risk.

The commercial real estate market is divided into six primary asset classes. Real estate experts and investors share different perceptions when it comes to ranking property and area classes. Most will rank them on a general scale from Class A to.

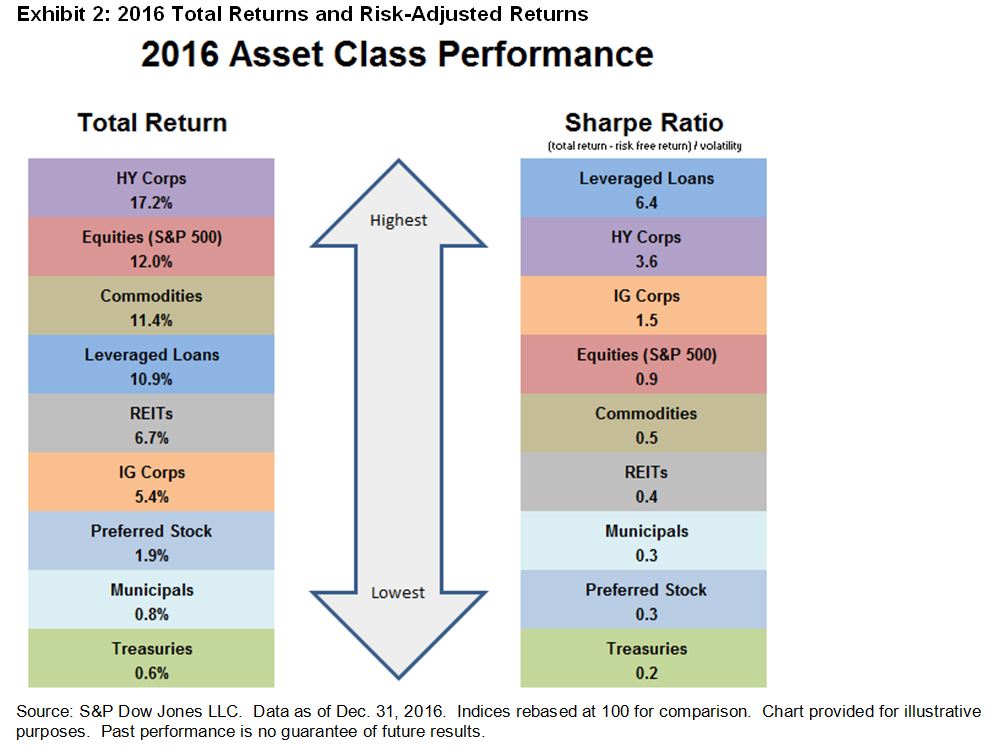

What kind of building are you investing in. Equities offer an ownership stake in a business. The top-performing asset class so far in 2020 is gold with a return more than four times that of second-place US.

In commercial real estate this gets defined as Class A B C or D. The sacred cow of real estate asset classes has consistently been core assets such as retail office and Class A multifamily. The first asset class is real estate.

On the other hand real estate investment trusts REITs.

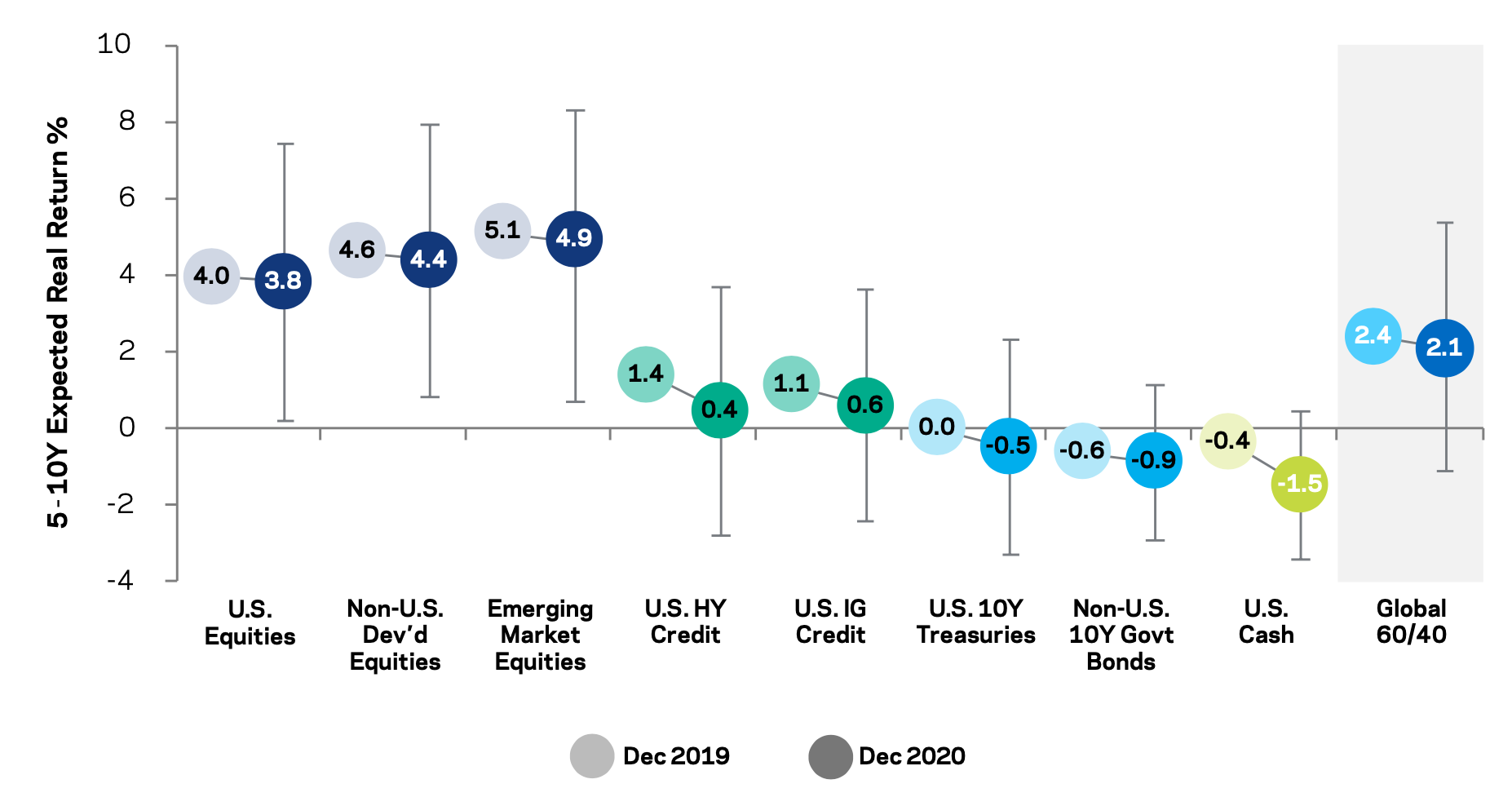

Expected Asset Class Returns Medium Term 5 10 Years Daytrading Com

:max_bytes(150000):strip_icc()/AchieveOptimalAssetAllocation-02-0e9eaa2219934b4cb85c48fb9db7b45c.png)

Determining Risk And The Risk Pyramid

Know Your Real Estate Risk Reward Spectrum Before Investing

Understanding Real Estate As An Investment Class Mckinsey

Ubs Tactical Asset Allocation Wheel Portfolio Management Finance Class Modern Portfolio Theory

Year In Review 2016 Asset Class Performance Seeking Alpha

Fifth Wall Closes New 503 Million Fund The Largest Real Estate Venture Capital Fund Raised To Date Venture Capital Help Wanted Real Estate

/AchieveOptimalAssetAllocation-01_2-8450dfb785a04b43b234ca4c050396db.png)

How To Achieve Optimal Asset Allocation

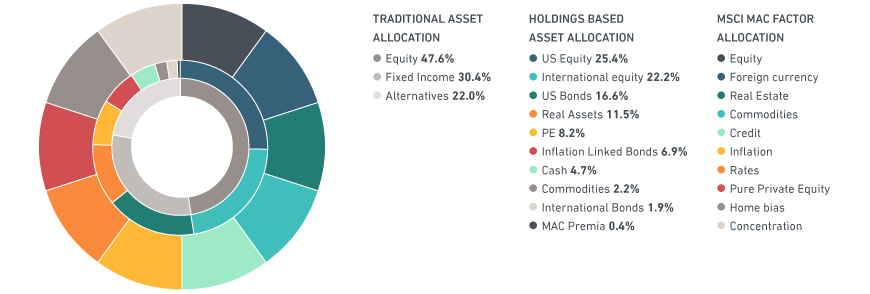

Multi Asset Class Factor Models Msci

:max_bytes(150000):strip_icc()/AchieveOptimalAssetAllocation-01_2-8450dfb785a04b43b234ca4c050396db.png)

How To Achieve Optimal Asset Allocation

All About Asset Classes And Investment Diversification The Motley Fool

Expected Asset Class Returns Medium Term 5 10 Years Daytrading Com

Multi Asset Class Factor Models Msci

Understanding Real Estate As An Investment Class Mckinsey

Commercial Real Estate Trends Toptal

These Exquisite Quilts Illustrate The Importance Of Diversification In Investing Investing Business Insider Asset

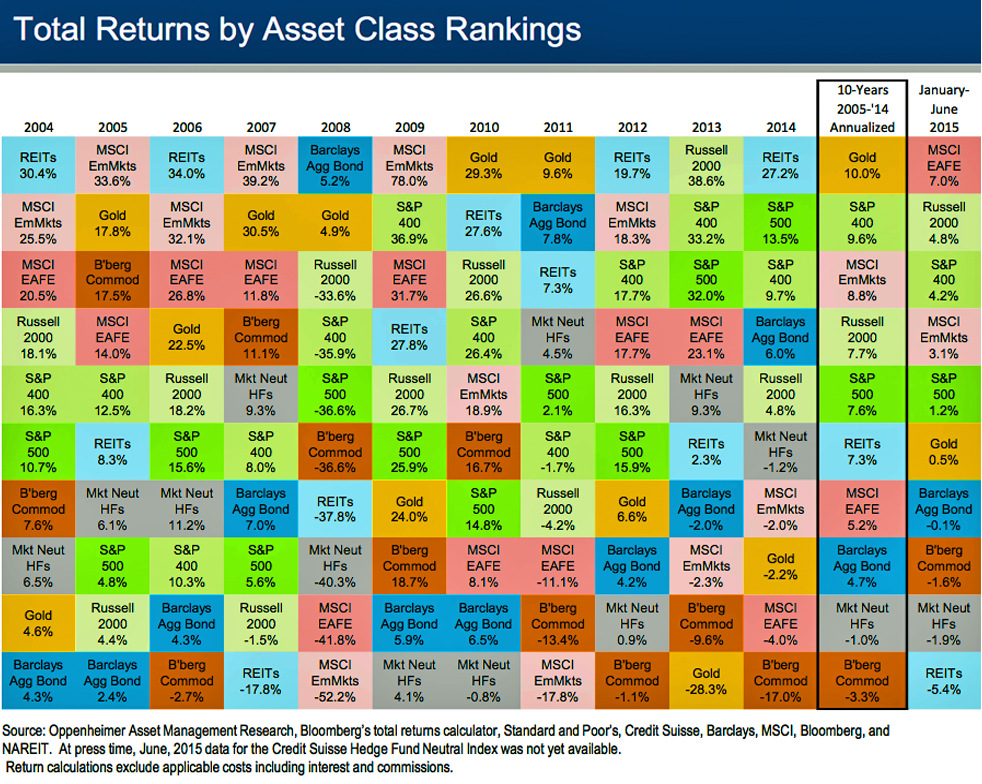

Ranking The Historical Returns Of Asset Classes Types Of Graphs Asset Historical

What Are The Major Asset Classes For Investing Types Of Assets

Chart The Historical Returns By Asset Class Over The Last Decade